Want to save money at home this year? Maybe you have your eye on a new refrigerator or a get-away? The 52-week money saving challenge is an easy way to set aside that cash, to get quick and easy savings. Plus we’ll tell you how to add bonus dollars to your savings!

What is the 52-Week Money Challenge?

Many of us struggle with putting aside extra money. If we told you that you needed to save $1400 extra this year, that might seem a little overwhelming.

The 52-Week Money Challenge makes it easier to save money, by breaking down your savings goal into smaller, achievable goals.

How Does the 52-Week Money Challenge Work?

Here’s how the 52-Week Money Saving Challenge works:

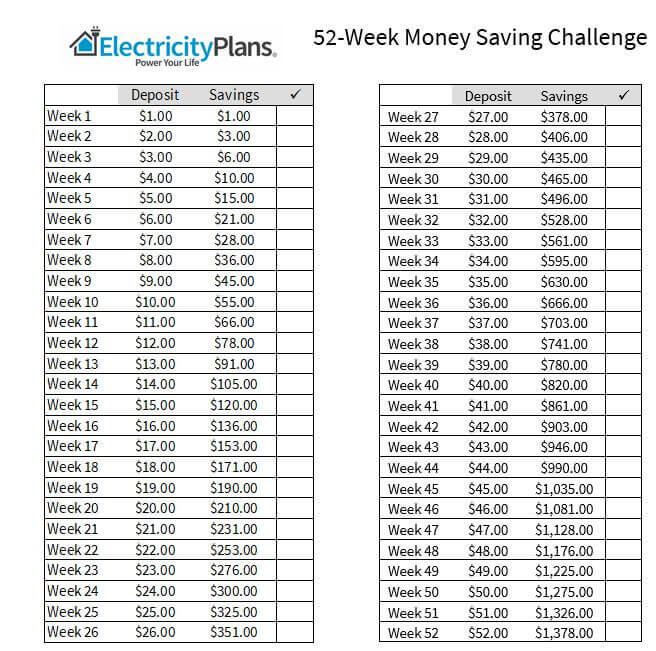

The first week, put $1 in your money saving jar. The next week, put $2 in your money saving jar. Continue, adding an extra dollar each week. On week 52, you will put $52 in the jar. And when you empty your jar? You will have saved $1,378.

Here’s what your savings plan will look like:

Don’t just print this off and put it on your fridge. (Wait, how did we just read your mind?) Download the full PDF, print it off and tape it to a jar. Then put in in a visible location. We’ll explain why below.

Why Does the 52-Week Money Saving Challenge Work?

The 52-Week Money Challenge (and other savings challenges) work through psychology.

If you’ve tried saving money before (or losing weight, or quitting smoking), you know the drill. You start off with good intentions, but then get discouraged, or maybe skip a few weeks. Then you quit.

The psychology of the money saving challenge is this:

Building a Habit – When you do something consistently, you build a habit. Each time you perform that behavior (in this case, putting money in a jar every week), you are building small changes in your brain. Your perform the act of saving, your brain feels happy, and that reinforces your behavior.

Making a visual reminder – Using a jar and a savings chart supports building a habit. You’ll have the visual cue of the chart. Plus you’ll have the positive feedback of seeing money go into the jar and build over time.

TIP: Drop in loose change each week when you clean out your pockets or purse. That loose change adds up. The average household will save around $68 each year in change.

Consumerist.com

Save an Extra $50+ a Month.

There are many ways to save around your home, just by making changes to your utility bills. If you can save just $50 a month with changes to your utilities, that’s another $600 that you can add to your savings!

The easiest way to save is by looking at your electricity bill, especially if you live in Texas, Ohio, Connecticut or other deregulated electricity market.

Last year we helped a Certified Financial Education Instructor and financial blogger identify a $23.26 a month savings on her electricity bill. That’s $279.12 that she will save each year.

Everyone’s savings will vary. But we can tell you that every day, we review bills for consumers to advise them on their electricity plans. And if your contract expires, you could pay 50% more than available rates. And it always pays to shop for electricity when your contract expires.

Shop for Texas Electricity Plans to Save Money

You can find other big savings on your water bill, natural gas bill, cell phone and cable or satellite. Just follow our Ultimate Guide to Saving On Utility Bills to implement these savings approaches.

Easy Hacks the 52-Week Money Savings Challenge

Want to increase your savings or change it up? Here are 5 easy ways to hack the money savings challenge.

Reverse 52-Week Money Savings Challenge: Most people start the money savings challenge in the first week of the new year. That puts your largest deposits during the holiday season when money is tight. With this approach, simply reverse the savings and start from the bottom of the chart. Your first week, save $52, then $51, etc.

$5 Money Saving Challenge – This one is fun. Every time a $5 bill comes into your hand, put it in the jar. No cheating — if you are getting $5 in change, don’t ask for it in ones!

365 Day Penny Challenge – If saving each week is stretching your budget, do a daily penny challenge instead. Day one is one penny … all the way up to 365 pennies ($3.65) on the last day of the year. Your pennies add up fast. At the end of the year you will have saved $667.95.

Monthly Money Saving Challenge: Put $100 in your jar in month one. Then $105 month 2 and so on. By next December, you’ll be saving $155 a month and have $1,530 in your jar.

DIY Money Saving Challenge – Have Microsoft Excel? Download the Microsoft Office Savings Estimator sheet. Set your financial goal and when you want to reach it. Then let Excel do the work. It will break down your goal in daily, weekly and monthly savings targets.