No matter where you live, there will always be fluctuations in the amount of power you use and pay for each month. This also means having months where the electric bill can be as much as twice the normal amount in extreme weather.

Electricity providers have created a system that attempts to solve this problem: average billing. Also known as budget billing, average monthly billing, or balanced billing, average billing aims to smooth out the bumps in your monthly electric bill. Ideally, this should result in a predictable electricity bill each month. But is average billing for electricity worth it? It depends.

How Average Billing Works

The goal of average monthly billing is to have 12 bills each year that are as close to identical as possible. By using average billing, you should be able to have a predictable electric bill similar to your other monthly expenditures like rent, mortgage, or car insurance.

Electricity companies use a formula to determine the amount you pay each month.

- They add up the past 12 months’ historical kWh usage

- They divide that sum by 12 to get an average monthly electricity usage.

- That average monthly electricity usage is multiplied by your current electricity rate to determine your average bill.

If you haven’t lived in your house for the entire prior 12 months, most companies will use the historic meter data from the property combined with your current electricity rate to calculate an average bill.

Average Monthly Billing Example:

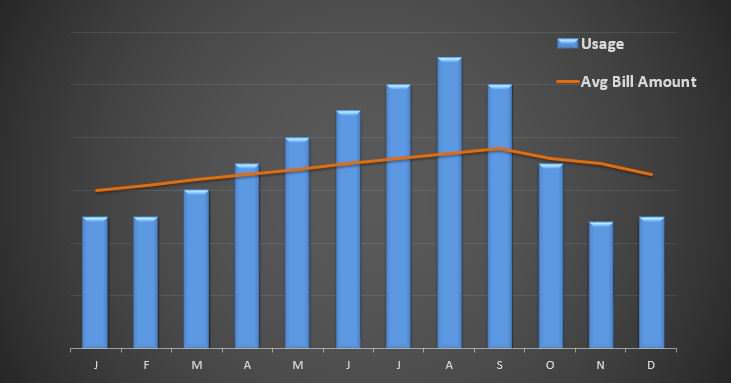

As you can see in the above example, in average monthly billing you’ll pay more for the electricity you use in some months while paying less for it in others. In this example (a typical usage pattern for residents in the southern US), customers with average billing would pay more in the winter and less in the summer compared to someone who pays for actual usage monthly.

[optin-monster-shortcode id=”hornjcl2z6vic5lypupv”]

Average Bill Calculation

This is where it gets a bit more complicated. Once the initial average bill is determined it is then evaluated and adjusted each month.

You may initially think that’s a bad thing. “Hey! I wanted to pay the same amount each month!”

But if they just continue to charge you based on your historical usage, you may end up over- or under-paying. Which is a very bad thing.

Think of it this way. Last year may have been a mild summer, and you went away for 2 weeks in August.

This year it may be a scorcher, and you would use a lot more electricity than last year.

At the end of 12 months, if they just used your average usage from last year (i.e. from the mild weather year) you would owe a boat load of money. And that’s never a good thing.

So here’s how electricity companies calculate average billing:

Your average bill will be adjusted based on the previous 12 months energy usage on a rolling basis plus or minus an adjustment for a portion (usually 1/12) of the “deferred balance”, “accumulated variance”, or “average billing plan balance”.

Source: Fine print everywhere

Huh? Ugh, math. Think of it this way.

You are paying each month based on an average of last year’s usage. Each month you will be over or under-paying for the electricity you actually use. That creates a deferred balance — money that you owe them or that they owe you.

By adding 1/12 of your deferred balance to the amount due the next month, it should, in theory, keep you from grossly over-paying or under-paying throughout the year. That way you’re not left with a huge deferred credit balance (the provider owes you money), or a deferred debit balance (you owe the provider money) at the end of a 12 month cycle.

Average billing can be a useful plan in some circumstances, but it’s far from perfect. Let’s break it down:

Average Billing Benefits

If you have lived in your home for several years and have consistent energy usage year over year, average billing could work well for you especially if you live on a fixed income.

The key is consistent energy usage year over year. Average billing helps smooth out seasonal fluctuations in your energy bill and keeps it predictable.

Average Billing Pitfalls

The deferred balance is basically the slush fund for all over-payments and under-payments as compared to your average bill.

In a perfect world, the deferred balance should be close to zero at the end of a 12 month cycle. But, because the average bill is calculated based on past energy usage, any variance in current energy usage will leave you with a deferred balance that doesn’t clear out at the end of a 12 month cycle.

When you enter an average billing arrangement matters. If you begin average billing with your provider at some point well into a 12 month electricity contract, you risk having a large deferred balance when your contract expires. This is because you haven’t had a full 12 months to work through the over-payments and under-payments that define average billing.

Weather extremes impact your energy usage and could seriously impact the deferred balance with your provider. Also, if you haven’t lived in your house for the last 12 months, then the calculated average energy usage is based on someone else’s habits and not your own.

Additionally, having close to the same bill each month can make you more lax when it comes to energy conservation. It can be easier to leave lights on and not monitor your thermostat as closely if it won’t hit your pocketbook at the end of the month. However, any changes in energy usage habits end up in a deferred account balance at the end of the month so at some point you’ll have to pay for it.

Don’t let your electricity contract lapse, especially if you are on average billing. If you don’t switch providers or renew your electricity contract when your contract expires, you will continue to be served by your current provider on an expensive month to month holdover rate. This is very bad for average billing because your electricity is now much more expensive that it was under a contract rate. Even if the new rate is reflected in your updated average bill, the cost of the electricity used versus what you’ve paid for with average billing will be greater. Your deferred balance will increase at a much greater rate.

What Happens with a Deferred Account Balance on Average Billing?

Deferred Balance “Debit” (Positive balance)

If during the course of a year on average billing, you have consistently used more energy than you have paid for on average billing, then you will have a deferred debit balance. You will owe that balance to your provider. When you switch providers any positive deferred balance will be due with your final bill.

It’s similar to under-paying your income taxes. You will have to eventually pay.

Most providers will monitor this balance and increase your average bill if you are accumulating a large deferred debit balance because providers don’t like for customers to underpay.

Deferred Balance “Credit” (Negative balance)

On the other hand, if you have consistently paid more on average billing that what you have actually used over the course of a year, then you will have a deferred credit balance and the provider owes you money. When you switch providers any negative deferred balance will be credited to your final bill.

However, providers are not as likely to monitor this balance as closely and decrease your average bill. A deferred credit balance is similar to over-paying your income taxes.

You’ve essentially given your electricity provider a loan and you’re not getting interest on it.

TIP: Monitor your bill. If you have a deferred debit or credit balance over $100, contact your electricity provider and ask if they can review your monthly payment. This will help ensure you don’t have a large deferred balance at the end of your contract.

What Happens at the End of My Contract on Average Billing?

The pain point on average billing comes at the end of your contract term.

If you have a deferred credit balance (negative balance – they owe you money) it’s easy. If you choose to continue with your current provider, your credit balance can be used to offset future electricity bills. Or, you may request that they refund the balance. Choose to switch providers? Then your current provider is required to pay you the balance.

If you have a deferred debit balance (positive balance – you own them money), it’s potentially painful. If you decide to switch to a new electricity provider, you will be required to pay the full balance of what you owe to your current provider. Your provider may be able to work with you on a payment plan even if you switch away. Or you can stay with that provider and they can wrap your debt into a new average billing plan.

This is why it’s so important to monitor your deferred balance. If you have a large deferred debit balance (i.e. you are incurring a debt to your electricity provider), it limits your options.

TIP: Electricityplans.com offers a free electricity shopping service in Texas. If you are confused about your debit or credit balance on your average bill, and are at the end of your contract term, we can help you figure it out. Just fill out the PlanScan form, attach a copy of all pages/sides of your bill and let us know the situation. We’ll review your bill and get back to you within one business day.

Is Average Billing Right for Me?

While average billing may sound like a great solution for managing a budget, it does require monitoring. Understanding your electricity provider’s calculation for your average bill and keeping a close eye on any deferred balance will keep you from any nasty surprises on your future electric bills.

If you are on a fixed income and need consistent billing amounts, average billing may be worth considering. This is especially true if you have been in your residence for a few years and have stable usage. However, be sure to monitor the deferred balance on your monthly bill to verify that it doesn’t just continue to grow unchecked.

If your energy pattern changes considerably throughout the year or if you are planning a home improvement such as a new pool, know that you might not be paying enough with average billing. This underpayment could lead to a hefty true-up payment to your electricity provider.

Another Option: Fixed/Flat Monthly Bill

Many electricity providers recognize that consumers want one flat bill every month. Your house payment, car payment, internet payment (and income) all remain the same each month. So why not your electricity bill?

These types of offers are available in Ohio and Texas. In Texas, select “Bill Credit/Tiered Rates” when you shop.

With the Flat Bill plan, will pay a fixed amount up to a certain level of usage, and then a price per kWh for everything over that.

Think of this like a cell phone agreement with limited data. You have a fixed fee each month up to a certain limit, then pay for all usage over that. If you are sure you can stay in that usage level, this can be a good deal. Just make sure to read all the details. If you go over the usage level, you will be paying a higher than normal price per kilowatt hour.