What choices did Texas electricity consumers make in 2025? Our second annual electricity shopping review reveals how Texans shopped for power this year, and how those choices shifted compared to 2024.

Key Takeaways

More Texas consumers are locking in electricity contracts of 12 months or less.

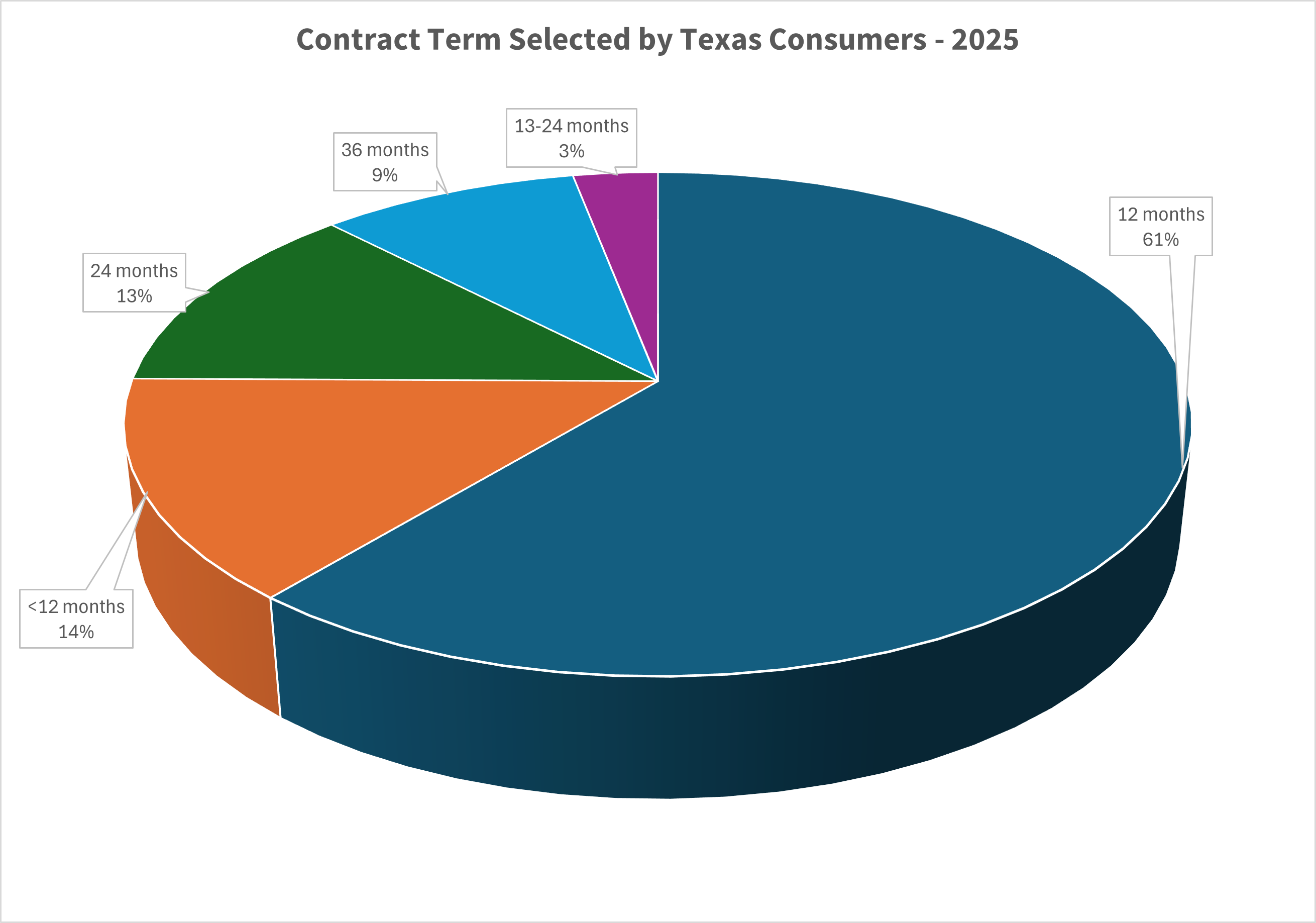

- Three quarters (75%) of Texas residential consumers picked an electricity contract of 12 months or less in 2025.

- Limited savings (3-5%) failed to persuade Texans to lock in longer contracts.

- We expect this trend toward short term contracts to continue as Texas wholesale prices entered a contango market in mid-2025, where long term contracts are more expensive than short term contracts.

What Contract Term Is the Most Popular in Texas?

As they did in 2024, most Texas consumers selected a 12 month fixed rate electricity plan in 2025, followed by contract terms lasting 6-11 months. Approximately 75% of all consumers selected a contract term of 12 months or less.

Compare that to 2024, when more consumers selected longer term plans.

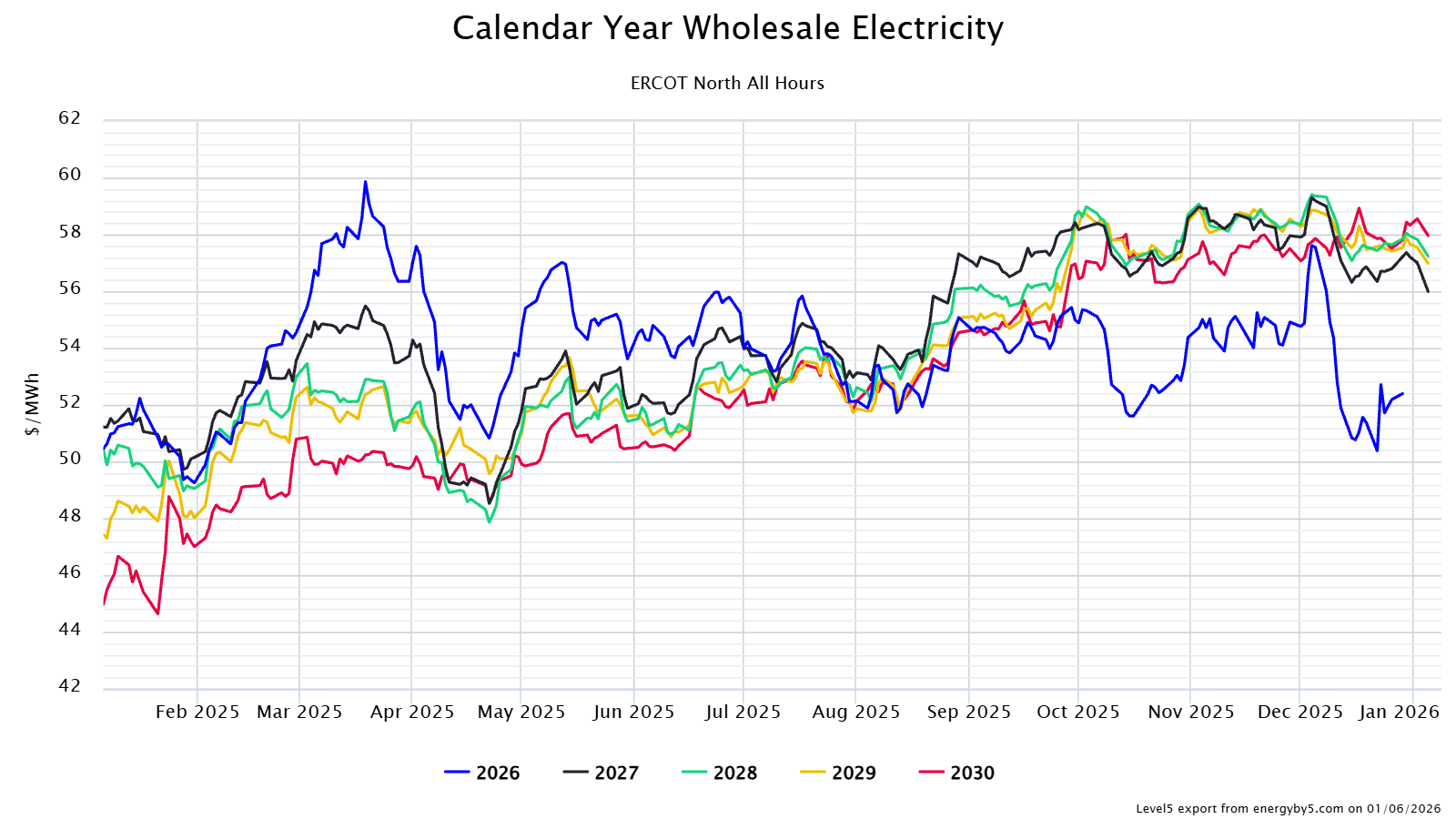

Why this change? In 2024, future electricity prices in the wholesale market were cheaper than near-term prices, making long-term contracts attractive. In mid-2025, that flipped, with short-term prices becoming cheaper than long-term prices, encouraging consumers to choose shorter contracts. (See graph below illustrating this point.)

In addition to minimal savings for long-term plans, consumers also select a 12-month contract term due to:

- Fear of being locked in if prices decline.

- Uncertainty around switching providers.

- Habit; many Texans shop annually.

Prices for Long & Short Term Contracts Converged in 2025

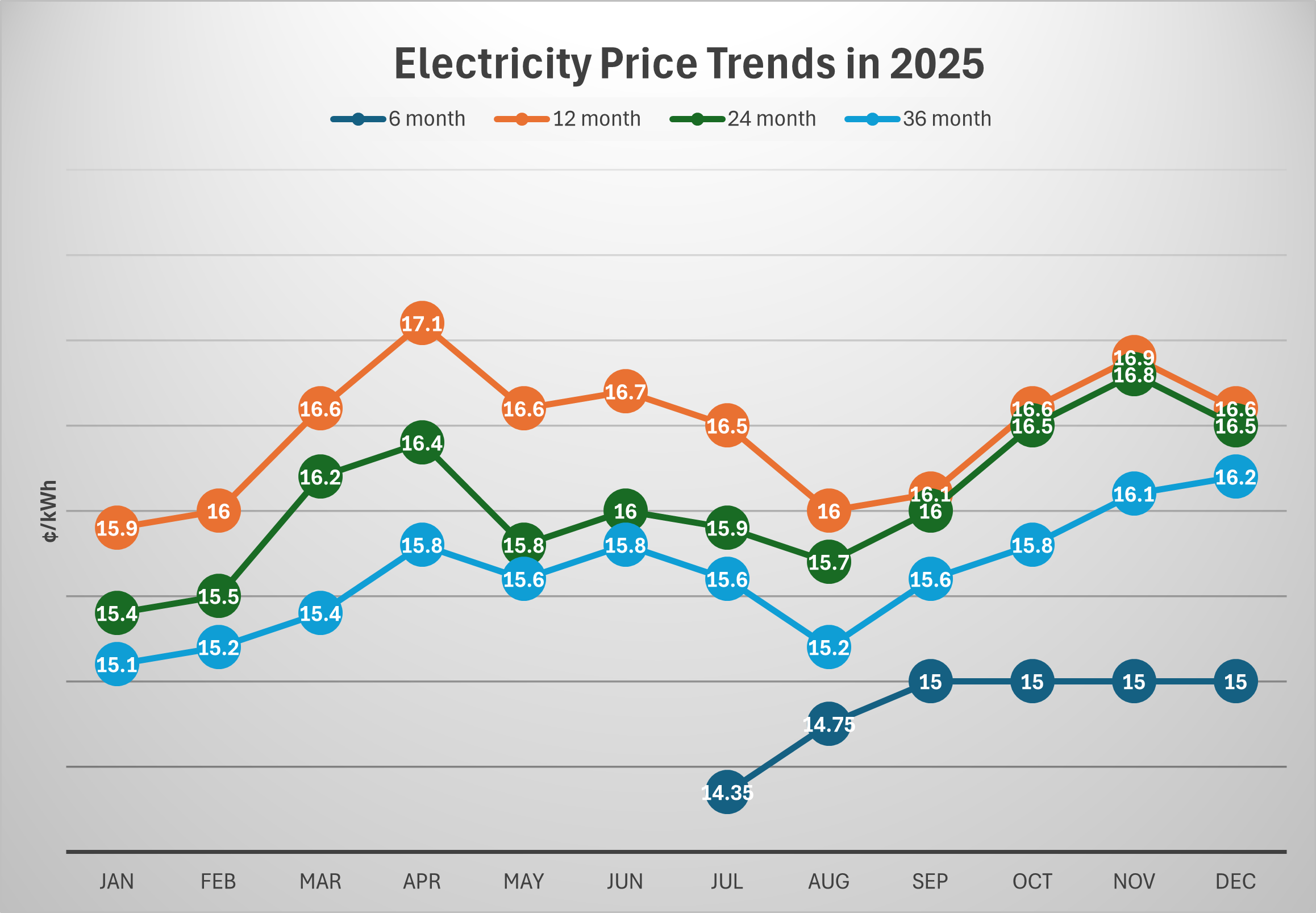

For the first time in several years, long- and short-term prices converged in 2025.

In 2023 and 2024, long-term contracts offered the lowest electricity prices. That was not the case in 2025. While we started the year with long-term contracts priced below 12 month terms, by mid-year the prices for 12 month, 24 month and 36 month contract terms converged. With no big savings to lock in, and a risk adverse attitude, consumers focused on short term contracts.

Unlike prior years, 2025 lacked their typical summer and winter price spikes. Prices even fell in August, likely due to milder-than-expected summer temperatures. While price fluctuations usually point to spring and fall as the best time to shop for electricity, the Texas market could be coming into a flatter year-round market.

Short term contracts, those less than 12 months, grew in popularity in 2025 due to their low prices, especially in the spring and fall. While short term 6 month contracts offer a low price, consumers may have to pay a considerably higher price on their next contract, especially if that subsequent contract begins in the summer.

This change in consumer electricity pricing is also reflected in the wholesale market.

The graph below shows wholesale market activity for ERCOT North (Dallas area). Each point in time represents the price of a 1-year contract on that date; for example, “On January 5, 2026, I can buy a 2028 full year electricity contract for $X.” Retail Electricity Providers buy wholesale electricity contracts. They stack multiple months or years of contracts to create consumer offers of 12, 24 or 36 months (or something in between).

Note the change in market trends in August 2025. Prior to that date, wholesale electricity contracts for future dates were cheaper than the current year, called a backwardated market. After that date, wholesale contracts for near-term contracts were cheaper than long-term contracts, called a contango market.

Bottom line, shopping preferences for a 12-month term, plus market changes, indicate that more consumers than ever will choose a 12-month contract for 2026.

FAQs – Texas Electricity Shopping Statistics

Based on consumer purchase behavior from ElectricityPlans.com, a comparison shopping site for Texas electricity, most popular type of electricity plan selected in 2025 was (1) fixed rate plan, followed by (2) bill credit/tiered rate plan and (3) plans with free electricity at certain times.

In 2025, the most popular electricity contract term in Texas was the 12-month contract term. According to data from ElectricityPlans.com, a comparison shopping site for Texas electricity, 61% of shoppers selected a 12-month term in 2025, compared to only 53% of shoppers selecting that contract term in 2024.

Yes, a short term plan less than 12 months can increase your risk of high bills later. Timing on your renewal matters most. For example, a 6-month contract can give you a low price from December to May. But you’ll be shopping again at the start of the summer season, which makes it unlikely you’ll retain that low rate.

We anticipate that short term contracts of 12 months or less will remain popular in 2026. That’s based on consistent consumer behavior patterns and market trends.

Not always. It pays to review multiple contract terms to see whether the best price is available with a short-term or long-term agreement. Market trends point to rates increasing over time, with some studies estimating a 30% increase in prices by 2030. A long-term contract can avoid price uncertainty in the future, and protect against rising prices.

About this data: ElectricityPlans.com is an electricity comparison marketplace that provides consumers with tools to evaluate and select retail electricity plans in Texas and other deregulated states. The data reflects all Texas transactions completed through the platform during calendar year 2025. This dataset should not be interpreted as a representative sample of the broader Texas electricity market. Results are influenced by self-selection bias, as the platform primarily attracts consumers actively seeking the lowest available rates or specific plan features. Less price sensitive consumers may be less likely to comparison shop and instead renew with their existing provider, often on longer-term contracts.