Where are electricity rates headed in 2018? You’ve likely heard rumors about tax cuts reducing your utility bill, but what are the other variables that will make your rates go up or down? Let’s examine the most important energy factors that will contribute to retail electricity price movements over the next 12 months.

UPDATE: Looking for 2019 Energy Trends? See Energy Trends to Watch in 2019.

The Influence of Natural Gas on Electricity Rates

Natural gas is the single largest fuel source for electricity in the US, accounting for 32% of the total electricity generated in 2017. This is largely due to it’s relatively cheap price compared to coal, nuclear, hydro, and renewables. It’s prices are important to follow since gas-fired power plants are responsive to grid demand and directly impact energy rates on most residential electricity bills. Natural gas prices are also directly tied to unusually cold weather since consumption increases and production temporarily decreases in cold weather.

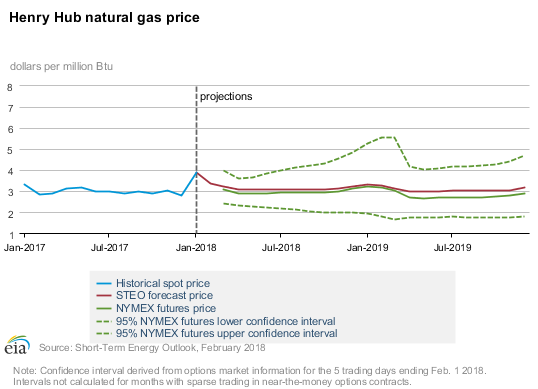

Natural gas prices spiked in early 2018 due to cold weather and impacted short term electricity rates. According to the EIA’s February 2018 forecast, wholesale spot gas prices are expected to moderate for the April – September 2018 time frame and a wide range of uncertainty beyond that.

Overall, the EIA’s February 2018 short term energy outlook is forecasting a slight nationwide increase in natural gas prices through the remainder of 2018. Natural gas delivered to electric power plants averaged $4.15 per thousand cubic feet in 2017 and is forecast to rise to approximately $4.39 in 2018. This will raise energy rates on electricity bills.

Coal’s Slow Demise

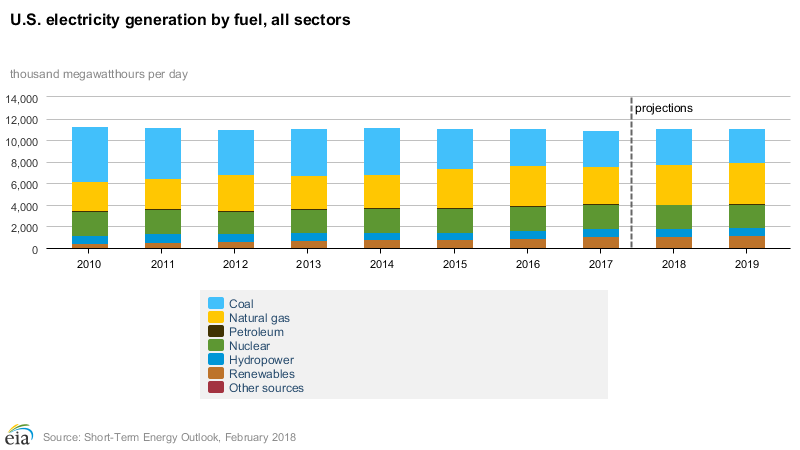

Despite efforts by the current EPA administrators to provide incentives and subsidies to coal, it will continue it’s diminishing relevance to electricity generators. As recently as 2010, coal accounted for 45% of all electricity generated in the US. In 2017, that number had declined to 31%.

Utilities are very aware of this trend. In a recent Vox article, Jim Robo, CEO of NextEra Energy, predicted that by the early 2020s, it will be cheaper to build new renewables than to continue running existing coal and nuclear plants. This is based on his predictions of wind producing at 2.0-2.5 cents per kWh and solar producing at 3.0-4.0 cents per kWh (all unsubsidized). Comparatively, he predicted the variable operating costs of existing coal or nuclear plants to be 3.5-5.0 cents per kWh.

More supporting evidence of coal’s decline is the rate of coal plant closures. To date, a total of 268 coal-fired power plants have closed in the US since 2010 and their generating capacity is being increasingly replaced by investments by utilities in renewables.

In addition to coal’s economic disadvantages, the New York Times recently reported a skyrocketing rate of black lung disease among Appalachia coal miners. This increased rate is attributed to longer working hours and deadlier silica dust from hard to reach coal seams.

Also, another advantage to the shift away from coal is the dramatic decrease in CO2 emissions from coal for electricity generation. However, the level of CO2 emissions has largely been offset by the increase in CO2 emissions from natural gas but because natural gas is less carbon intensive than coal, about 80% more energy was provided by natural gas (28.2 quadrillion British thermal units) consumed in 2015, compared with coal (15.5 quadrillion British thermal units).

The downside? Even though this change in fuel sources will likely help electricity prices 3 – 5 years down the road, the short term uncertainty will likely cause electricity rates to rise in 2018. For example, the retirement of 3 prominent coal plants in Texas’ ERCOT service area will cause increased strain on capacity in the summer of 2018 and increase the risk of electricity supply shortages.

Renewables Will Continue To Grow As Economical Electricity Sources

Just as coal’s share of electricity generation has declined, the use of renewables has grown rapidly. In 2018, renewables (excluding hyrdo) will account for almost 10% of the daily supply of electricity in the United States.

The key to using mainstream renewables such wind and solar for base load electricity? Storage. Increasingly, utilities are implementing battery storage solutions to solve renewable’s inherent problem of availability. In addition, residents are taking up the solar-plus-storage cause, especially in hurricane-prone areas such as Florida and Puerto Rico to reduce their reliance on utility grids.

For utilities, the dramatic price drop of lithium-ion batteries means that they can now entertain the idea of storing renewable energy and using it when demand arises. Estimates for the size of the storage market exceed 2.6 gigawatts (GW) by 2022. This puts the utilities squarely in the driver’s seat to ultimately determine energy rates based on future technologies. In addition, FERC recently issued Order 841 that directs RTOs to develop storage rules for utilities to use in the overall grid capacity planning process.

Grid Maintenance and Modernization Become Increasingly Costly

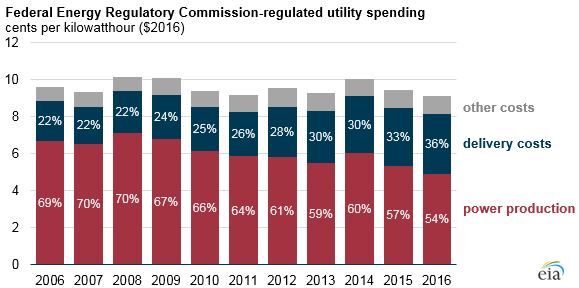

Major utilities have been spending more on transmission and distribution infrastructure. Since 2011, these infrastructure costs have risen dramatically. Costs such as expansion, smart meters, grid security, and extensive disaster recovery projects have all contributed to this growing expense. In some areas, transmission and distribution costs by local utilities now account for approximately 50% of the cost on residential electricity bills.

According to the EIA, the portion of total electricity cost related to power production has gone from 69% in 2006 to 54% in 2016.

The decrease in production cost has been more than offset by the increase in delivery cost which has gone from 22% of the total cost of electricity in 2006 to 36% in 2016. These delivery costs include transmission, distribution, smart meter deployment, other systems improvements, and, more recently, the rebuilding of major grid components due to extreme weather events.

For 2018, we see this increase in delivery costs continuing to rise and will unfortunately become an increasingly large percentage of your electricity bill.

The Impact on the 2017 Corporate Tax Cuts on your Electric Bill

Will the 2017 corporate tax cuts help your electric bill? Yes, probably. By how much? Unfortunately it’s anyone’s guess, but it will depend on which utility serves your area and if your utility is actually allowed to reduce it’s rates by the FERC and by the various state commissions.

In a letter to the Federal Energy Regulatory Commission written soon after the Tax Cuts and Jobs Act of 2017 was established, the attorney generals and other representatives from 16 states requested a reduction of utility’s revenue requirements in order to pass along the tax savings to consumers. We’ll have to wait on the results, but the bottom line is that utilities are likely to pass along some of the tax cuts to consumers. However, some states may allow utilities to use part of their savings to fund infrastructure upgrades or to offset future rate increases.

In theory, passing along savings in the form of rate reductions should save electricity customers billions and it will likely occur if the utilities are allowed to reduce rates. However, the rate changes will likely amount to only a few dollars of savings for each customer since various economists estimate that it will only reduce electricity rates by 0.5 percent per the New York Times.

The Bottom Line For Electricity Rates in 2018

The net effect of these market factors will likely lead to a rise in 2018 residential and commercial electricity rates in the US. How much? It will depend on your region, your electricity supplier, and your specific utility, but, unfortunately, it could be anywhere between 2-10% for new contracts.

For tips to find a better electricity plan, see The Basics: How to Shop for an Electricity Plan.