Texas electricity rate trends for 2026 show prices similar to 2025. Our Texas electricity rates trend forecast includes key factors driving electricity prices and what types of electricity plans will be popular this year.

Whether you live in Houston, Dallas or another area, the question is always, “Will electricity prices in Texas go down anytime soon?” Don’t bet on it.

Key Takeaways

For 2026, here are 4 key takeaways on Texas electricity rate trends.

- Texas electricity prices for 2026 will continue at levels seen in 2025. Residential electricity rates in Texas will average 14-19¢ per kWh including delivery costs.

- Texas commercial electricity rates will average 7-9¢ per kWh plus delivery costs.

- Longer term contract terms (24 to 36 months) will be the cheapest electricity options.

- Pricing continues to show seasonality, with the best time to shop for electricity in the spring and fall.

Contents of this Article

- What’s the Projection for 2026 Texas Electricity Rates?

- How Do Texas Electricity Rates Compare to National Average?

- Factors the Drive Texas Electricity Rates

- Short Term vs. Long Term Power Contacts in 2026

- Trending Electricity Plans for 2026

- Power & Politics: How Legislative Decisions Impact You

- Texas Electricity Trends FAQs

What’s the Projection for 2026 Texas Electricity Rates?

In the short term, we expect a modest 3-5% rise in electricity prices in Texas from 2025 to 2026. Residential electricity rates will be 14-19¢/kWh including delivery costs, and commercial electricity rates will average 7-9¢/kWh excluding delivery.

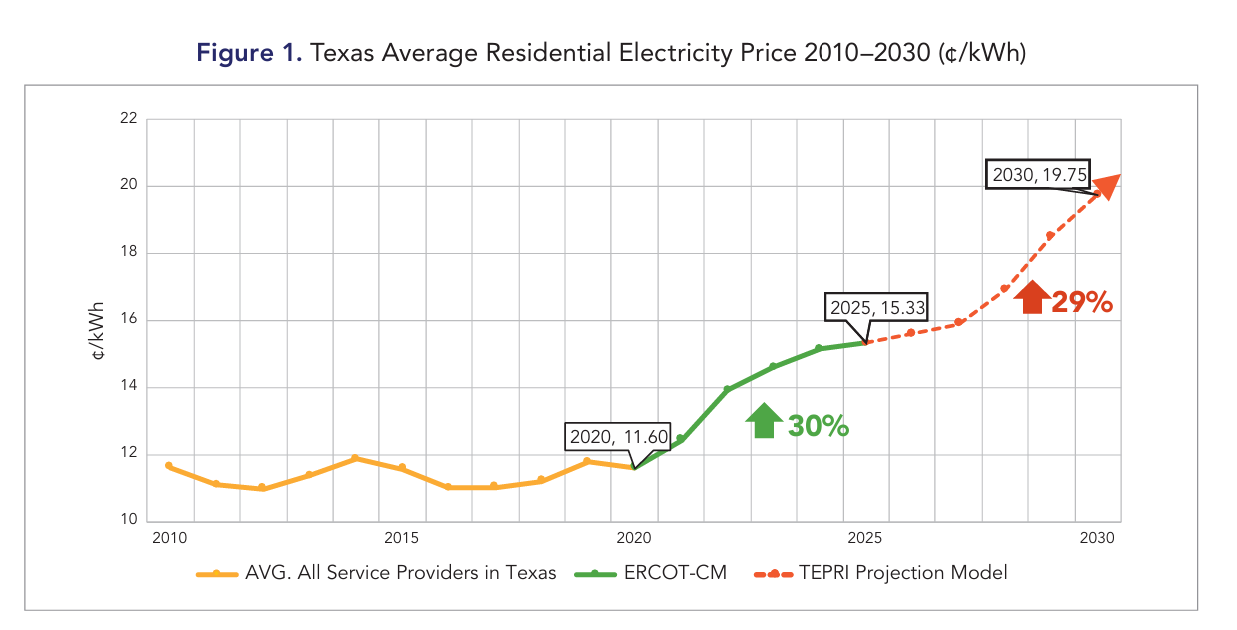

But looking at the history of rates? We know that electricity prices in Texas are up 30% from 2020 to 2025. And projections from industry analysts indicate rates will go up another 29% by 2030.

Those stats and the chart below are from TEPRI’s energy affordability study. They worked with multiple economists and industry experts to develop this forecast of Texas electricity prices.

Projected rate increases are primarily due to transmission and distribution investment and cost recovery. Consumers will pay the $32 billion in new utility infrastructure costs. The PUCT has approved those investments between now and 2032.

What’s this mean for consumers? You can control your electricity bill in two ways. (1) Reduce your usage, which impacts both the energy and delivery portions of your bill. (2) Lock in the lowest fixed energy rate available since your energy rate is the only part of the bill with a choice of provider.

How Do Texas Electricity Rates Compare to National Average?

Texas electricity rates are consistently lower than the national average. Over the past three years (August 2022 to August 2025) Texas rates have been 10% lower than national average. (Source: EIA)

However, Texas electricity rates are increasing at a faster pace than national average rates. Texas electricity rates increased by 29% rising from 11.7¢/kWh in 2020 to 15.1¢/kWh in 2024. During the same time period, the U.S. Average rate increased by 25%, from 13.15¢/kWh in 2020 to 16.48¢/kWh in 2024.

You can compare Texas electricity rates vs other states using our monthly tracker. You’ll find average rate, estimated monthly bill and average usage by state with the most current data from the Energy Information Administration.

Factors the Drive Texas Electricity Rates

There are a number of key factors that drive Texas electricity prices. Our assessment is based on 20+ years of experience in the electricity market plus input from industry professionals.

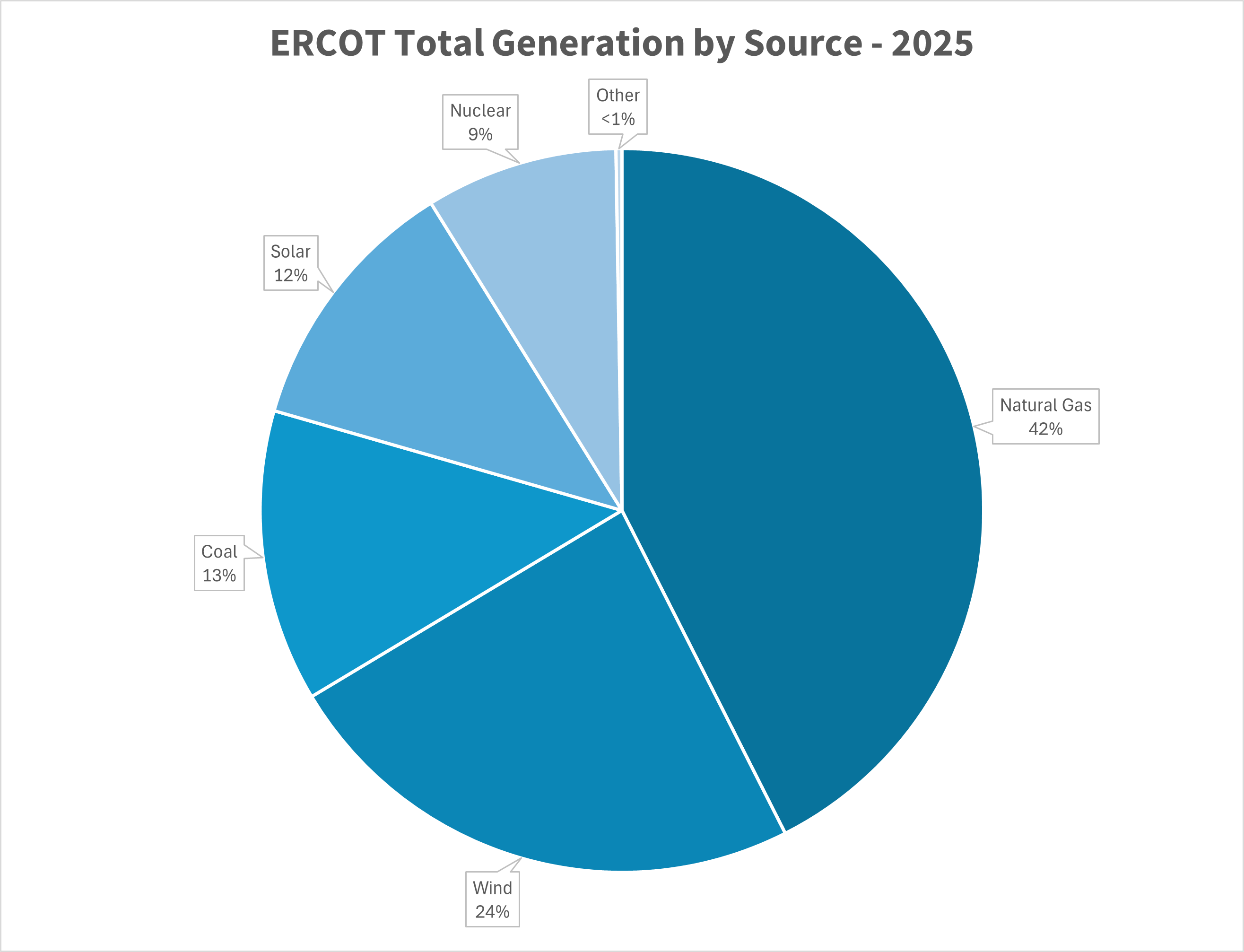

- Natural Gas Prices. Natural gas accounts for 42% of the power produced in Texas and natural gas prices continue to drive Texas electricity rates.

- Infrastructure Development. As Texas grows, so does the need for new transmission and distribution lines. A new Strategic Transmission Expansion Project will bring extra high voltage power lines that can move power longer distances with fewer line losses. That comes at a cost of $32 billion over the next 6 years. Additionally, TDUs like CenterPoint and Oncor are investing in their distribution network. All of these transmission and distribution costs will impact your bill.

- Supply & Demand. Texas’ demand for electricity has increased by 30% since 2020. Texas electricity demand growth is being being driven by three factors: (a) artificial intelligence and data centers, (b) cryptocurrency mining and (c) hydrogen electrolysis, an energy intensive industrial process.

- Weather Patterns. Texas’ weather is one of extreme heat during the summer plus extreme cold for brief periods each winter. This weather drives higher trading prices for electricity in the summer and winter, driving up the overall cost of your contract.

- Changing Generation Mix. Wind and solar provided nearly 40% of Texas’ power during the first nine months of 2025, according to EIA data. This lower cost electricity generation pushes wholesale prices down, but natural gas prices for peaker plants, used in times of extreme need, push rates higher.

Texas Electricity Rates in 2026 – Average Price

- Average electricity rate in AEP Texas Central: 16.39¢ per kWh

- Average electricity rate in AEP Texas North: 17.86¢ per kWh

- Average electricity rate in CenterPoint Energy: 16.68¢ per kWh

- Average electricity rate in Lubbock Power & Light: 16.12¢ per kWh

- Average electricity rate in Oncor: 16.15¢ per kWh

- Average electricity rate in TNMP: 18.37¢ per kWh

Shop Current Electricity Rates by Zip Code

Short Term vs. Long Term Power Contacts in 2026

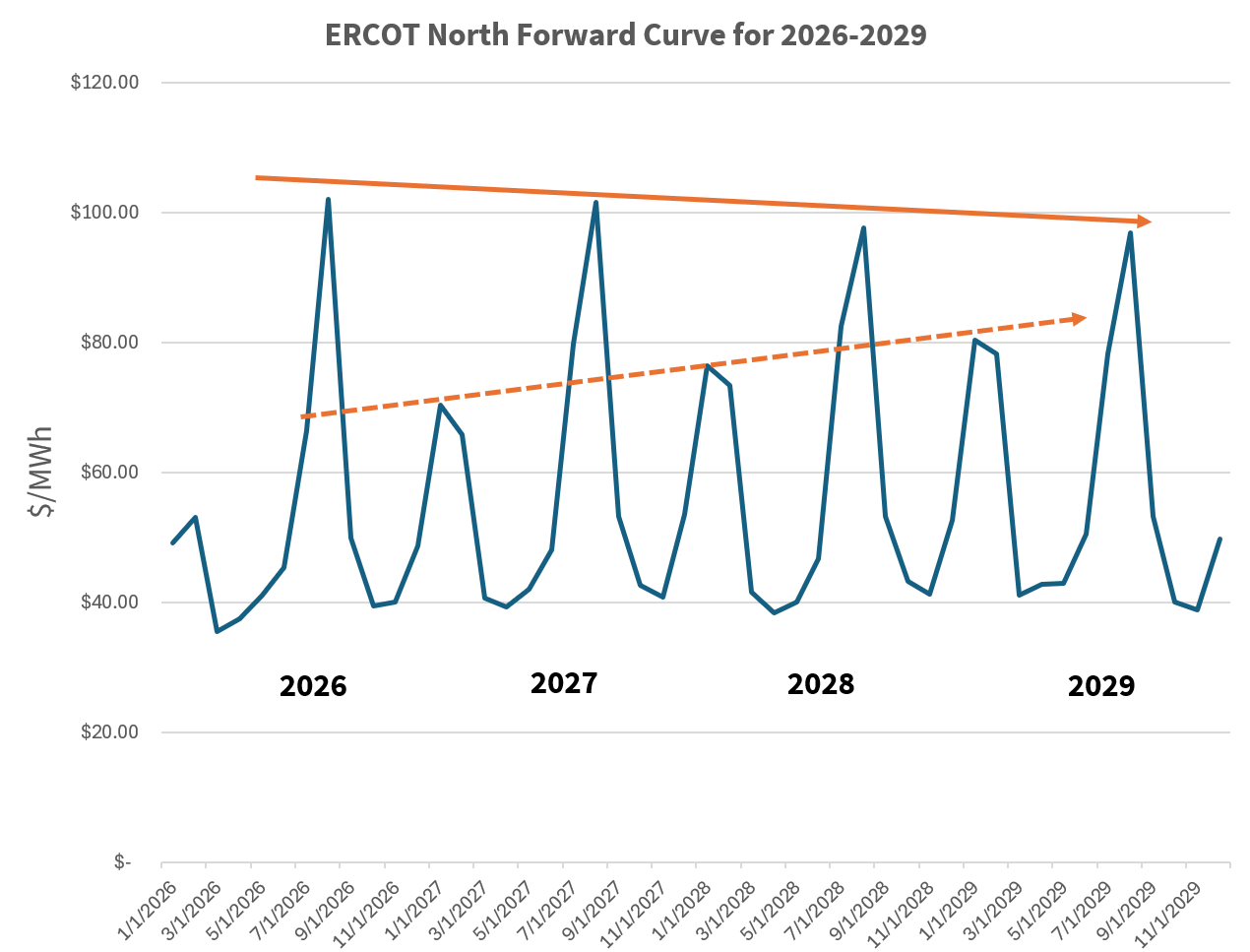

Following trends that we’ve seen for the past 3 years, long term contracts will provide the best value in Texas electricity rates in 2026.

Wholesale market trends are giving some conflicting information. Summer peak rates look to be trending down through 2029. Winter peak rates? They’re trending up through 2029, reflecting the grid risks inherent to Texas cold snaps.

But overall, the economics of supply and demand point to higher prices in the future. That makes it a smart bet to lock in longer term contracts now.

- A December 2025 forecast from the EIA projects ERCOT demand will grow by 9.6% in 2026.

- ERCOT forecasts a 50% increase in electricity demand by 2029, with demand growth driven by AI data centers, cryptocurrency and industrial processes.

- Ancillary services, designed to ensure that power is always available to the grid, increase costs and risks which affect your rates.

- New gas power plants will lag in development because gas turbines are supply-constrained through 2030.

- Market uncertainties also drive prices. Power traders are eyeing tariffs on steel and solar panels; the loss of government incentives for wind and solar; lower natural gas production paired with increasing gas exports; and Texas legislative debates on the power market structure.

Caveat for all of this. Don’t rule out shorter term agreements, especially moving into spring and fall. In fact, if you see an odd-term contract (like 8, 11, 14 months etc.), take a good look. Odd-term contracts are created to take advantage of market prices.

> Learn More: What’s Driving Electricity Demand in Texas?

Trending Electricity Plans for 2026

The most popular plans in Texas will continue to be fixed rate electricity plans and bill credit plans.

- Fixed rate electricity plans will continue to be the most popular type of electricity plans in Texas. That’s because no nonsense, no gimmicks basic electricity plans with fixed rates offer the best value for most consumers.

- Bill credit plans that show a low rate at a specific usage level will continue to drive big business for retailers. These plans look great at the advertised rate, but your effective rate will be higher. We encourage consumers to use our electricity plan calculator and Compare Plans tools to see what they will actually pay.

- Home battery systems will become a more common offering. You’ll pay a low price per kWh plus a monthly fee and an upfront installation fee for a back-up battery. You’ll get up to 24 hours of back-up power at your home, or more depending on the size of the battery. In return, the retailer gets a battery asset they control. They’ll make money by charging your battery at night when power costs are low (at no cost to you) and sell power onto the grid when prices spike.

Power & Politics: How Legislative Decisions Impact You

The biggest Texas legislative action in 2025 was the passage of Senate Bill 6 (SB6), which will significantly impact data centers, crypto miners and other large energy users. Key provisions of this bill include:

- New interconnection requirements. New large load connections will require a reliability impact study.

- Curtailment protocols. Large loads must allow ERCOT to have curtailment (shut-off) control during grid emergencies.

- Financial contributions. Large loads must pay their share of costs associated with their interconnection to the grid.

- Backup power requirements. Large loads must maintain back-up systems on-site. These can also be called on to supplement the grid during emergency situations.

Studies are underway at ERCOT on options to revamp the 4CP system which assigns grid capacity costs to consumers. 4CP or 4 Coincident Peaks measures each meter’s overall contribution to demand on the 4 highest usage days each summer. But large industrial users minimize their share of the costs by cutting their usage on those high demand days. That leaves smaller consumers footing more of the bills.

One study showed that residential consumers in CenterPoint use 33% of the electricity but paid 49% of the transmission costs. That allocation hardly seems fair to consumers.

The biggest takeaway of SB6 for consumers is that Texas government recognizes the impact of large data centers and is looking for ways to allocate costs to those that consume the most power.

>Read more: How Will Data Centers Impact Your Electricity Bill?

Texas Electricity Trends FAQs

Texas electricity prices for 2026 will continue at levels seen in 2025. Residential electricity rates will average 14-19¢ per kWh in 2026, including delivery costs.

The Texas long-term electricity price forecast for 2027 looks positive based on ERCOT reserve margins and forward market contracts. However, that can change based on regulatory concerns, market jitters and weather. Residential customers can protect their electricity rate for 2027 by securing a 2 or 3 year electricity contract now.

Higher prices in Texas are driven by increasing demand, regulatory changes, weather conditions and increased investment in power delivery infrastructure. You can see how Texas electricity rates rank vs. other states in this chart of electricity rates by state, updated monthly.

The best time to shop for electricity rates in Texas is spring and fall. Rates are historically at their lowest in April, May and October. And rates are typically highest in July, August, January and February.

Texas electricity increasingly comes from renewable energy. In 2025, 36% of Texas electricity came from wind and solar. By comparison, just 10 years prior, in 2014, 11% of Texas electricity came from wind and solar. Consumers can choose traditional energy, which is a mix of power sources, or green energy from renewable sources.

Yes, electricity prices are going up in Texas. Much of the projected increase is from delivery infrastructure investment, which trickles down to consumers in their delivery fees. Increasing demand from data centers will also drive wholesale energy prices higher.

Residential electricity rates in Texas include both electricity (energy) and delivery costs. The average rate in 2025 was 15.39¢/kWh according to EIA information. Consumers can expect to see prices ranging from 14 to 19¢/kWh in 2026. If you see advertised rates considerably below that, check the fine print. It’s likely you’re looking at a bill credit plan designed to look cheap at exactly 1000 kWh.

According to the EIA Short Term Energy Outlook, Texas electricity generation is 42% natural gas, 24% wind, 13% coal, 12% solar, 9% nuclear, with other sources generating less than 1% of the mix.