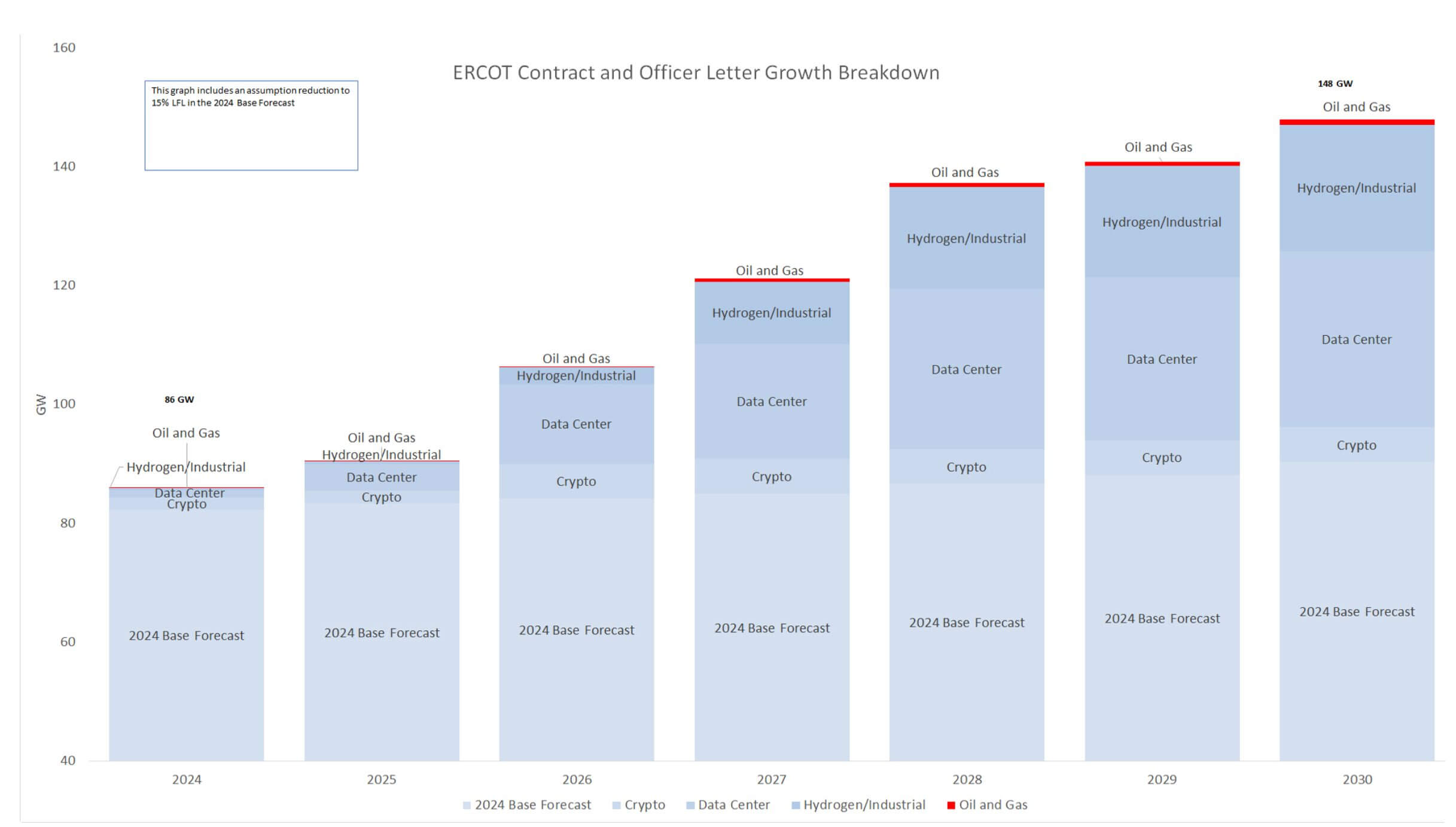

Summer electricity peak demand in Texas is expected to grow nearly 80% in the next 10 years, from 85,464 MW in 2023 to a projected 153,230 MW in 2033. And no, electric vehicles aren’t the cause.

According to the Electric Reliability Council of Texas (ERCOT), the entity responsible for managing the Texas grid, the three factors driving electricity demand in Texas are: artificial intelligence, hydrogen electrolysis and cryptocurrency mining.

In this article we’ll provide an overview of the factors driving demand, and how rising demand may impact your electricity prices.

Key Takeaways

- According to ERCOT, electricity demand growth in Texas is driven by artificial intelligence (AI), hydrogen electrolysis and other industrial processes, and cryptocurrency mining.

- Texas power prices may increase due to higher demand growth.

- Texas electricity demand is expected to increase by 80% between 2023 and 2033.

What are the Key Factors Driving Electricity Demand?

ERCOT has identified three factors driving electricity demand in Texas.

Data Centers / Artificial Intelligence (AI)

Artificial intelligence sounds like futuristic sci-fi but it’s a growing reality of everyday life. Use Google or Microsoft to research a topic? The top result is likely a summary written by AI. Need a resume? Chat-GPT’s AI model can create a version for the specific job you’re applying for. That online chat agent that helped you find the perfect outfit for a special occasion? Likely an AI chat bot, not an actual person.

But AI data centers take a lot of power.

For example, in an online discussion on LinkedIn, a commercial planner at one Texas utility commented on hyperscale data centers, saying “We have single data center customers that require us to seek new generation resources.”

Google just brought their “Orion Solar Belt” online in Texas, three solar farms built side-by-side and generating 875 megawatts of power, and designed to power their data centers.

As a non-Texas example, Microsoft is working with Constellation to re-start the Three Mile Island nuclear power plant in Pennsylvania. The company will purchase 100% of the plant’s generation to help power its AI data operations.

How much power does AI use? Estimations of how much power AI uses are rare, since AI developers consider that a competitive feature of their models.

Hydrogen Electrolysis

Hydrogen electrolysis is the process of using electricity to split water into hydrogen and oxygen.

Once produced, hydrogen can be used for power generation, transportation (fuel cell batteries), and heat-intensive industries like steel and chemicals. It’s also used in the refining process to produce petroleum products like gasoline and diesel.

How energy intensive is hydrogen production? Producing 1 kilogram of hydrogen requires 55 kWh, and the USA produces around 100 million metric tons of hydrogen annually, according to Energy.gov.

Companies like Exxon, Chevron, Oxy and more are focused on producing clean hydrogen as part of their global carbon-emission reduction goals. That requires hydrogen electrolysis powered by renewable energy resources (solar and wind) or power from nuclear or natural gas (when paired with carbon capture.)

Cryptocurrency (Bitcoin Mining)

Cryptocurrency mining operations across Texas consume huge amounts of power. These operations earn coins by using computers to solve puzzles in a decentralized database called the blockchain.

According to the Texas Blockchain Council, Texas crypto consumes more than 2,900 megawatts of of power annually, with new mines adding an average of 90 megawatts per month in demand.

Texas leaders have pushed for the state to become the cryptocurrency capital of the US. Crypto miners are attracted by lucrative tax incentives, low energy costs, plus demand response programs that pay them to reduce demand when asked to do so.

How Will Growing Power Demand Impact TX Electricity Prices?

All of this is interesting to know. But the important question is, how will power demand in Texas impact electricity prices for your home or business?

Our expectation is that power prices will remain in the same range for the foreseeable future. Because where there is projected demand, supply will be built to meet it.

A significant amount of new development will come from solar and battery storage. Both have a lower generation cost than power from natural gas or coal. This will push prices downward.

Developers are also building “dispatchable capacity” in the form of smaller-scale gas turbines that can be turned on as needed to avoid price spikes.

And the Texas Energy Fund, approved by voters in 2023, made $5 billion in low cost loans available to invest in additional power plants. (Note: as of 4/15/2025, over 1/3 of those proposed power plants have backed out of the program, citing lack of turbine availability in time to meet required deadlines.)

So we’re bullish on power prices remaining stable over the next few years, even as demand skyrockets.

However, transmission and distribution costs (your delivery fees from the utility) will continue to grow and have a bigger impact on your bill. New generation will need to connect to the grid. Plus grid strengthening and expansion are infrastructure projects with a guaranteed rate of return for the utility, thanks to state regulations.

Locking in a long term contract for your home or business is the best protection against future increases in energy costs. After all, it’s the only part of your electricity bill you can control. Compare prices for commercial electricity online to find the best rates for your business.

>>You can learn more about Texas electricity trends in our article on that topic.