Where are energy rates going for 2019? And what are the trends to watch? In this article we examine some of the important factors in energy rates, including the price of natural gas, continued closure of coal-fired plants, the increase in renewable energy generation, and the falling costs of battery storage.

The Influence of Natural Gas on Electricity Rates

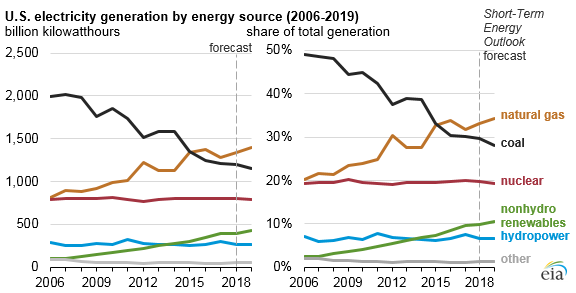

For 2019, natural gas remains on top as the single largest fuel source for electricity in the US, generating 35% of all power in the US. While the US has made steady progress in wind development (especially in Texas) and solar development (driven by utility incentives in the northeast), natural gas plants are still needed for reliable baseload generation. Gas prices are important since gas-fired power plants are responsive to grid demand and directly impact energy rates on most residential electricity bills.

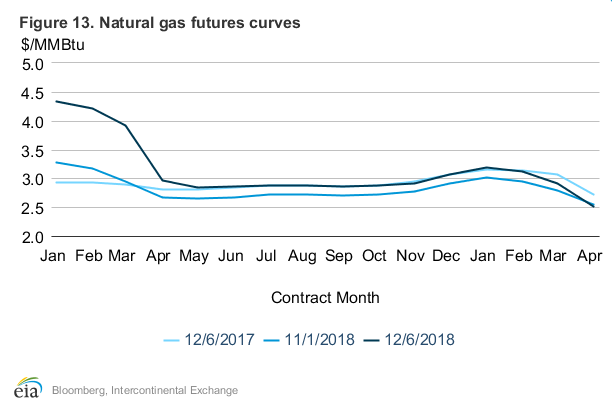

Natural gas prices spiked in late 2018 and early 2019 due to cold weather and that impacted short term electricity rates. However, the EIA Short Term Energy Outlook projects that natural gas prices will fall after the winter, on strong supply.

The EIA expects that natural gas production in April 2019 will be 90 Bcf/d—2 Bcf/d higher than current levels—putting downward pressure on prices as demand declines after the winter.

One possible impact on natural gas prices is the expanding market for Liquified Natural Gas (LNG) exports. US LNG Exports are expected to double in 2019, with 18 new LNG export terminals coming online in 2019. The US is currently the 3rd largest exporter of LNG, after Australia and Qatar.

Coal Plants Will Continue to Shutter

The current administration has been pushing for coal and nuclear power plants to continue operation, loosening regulations and providing incentives. In late December 2018, the EPA announced plans to roll-back a carbon emissions rule on new coal plants, reducing requirements for equipment to limit and capture carbon dioxide emissions.

Despite this relaxation of standards, government data shows that US coal consumption is at its lowest level in 39 years, and changes in regulation are unlikely to change that. According to the EIA, in 2018, 27% of power was generated from coal-fired plants, down from 30% in 2017 and down from almost 50% a decade ago.

Coal-fired power plants will continue to close simply due to the economics of progress. Older facilities are costly to maintain, natural gas is a more efficient way to generate electricity and there is increased competition from renewable energy.

In 2018, 14.3 GW (gigawatts) of coal-fired power plant capacity were retired, up from 7 GW retired in 2017. Another 23.1 GW of coal plant retirements have already been announced for 2019-2024.

The EIA projects that coal-fired electricity generation will continue to decline. Industry leaders concur. NextEra Energy Inc. Chairman, President and CEO James Robo has stated that the new build cost of wind and solar is below the operating cost of existing coal and nuclear power plants in the U.S. The low cost of renewable generation and the rise of efficient battery storage make the shift away from coal inevitable.

The location of the additions and retirements of electricity generation facilities also represents a significant geographic and economic shift.

In the midwest, the EIA predicts that most new generation in 2019 will come from wind, while most new sources in the east will be from solar and natural gas. This shift in the source of electricity represents a move towards both cheaper and cleaner electricity. However, it will also introduce some price uncertainty, especially in Texas, as ERCOT learns to forecast and manage loads from new sources .

The Year of Renewable Energy and Batteries

The use of renewable energy has grown rapidly, now at 11% of US generation and will continue to expand. Why? Costs have dropped to the point that solar and wind energy is a competitive alternative to natural gas plants. Additionally, the cost of battery storage systems have dropped significantly in the past decade, with Bloomberg New Energy Finance predicting that prices will fall by over 50% between 2018 and 2030.

Why are batteries important? The challenge with wind and solar production has been one of timing and transmission availability. Electricity is transmitted when it’s generated. The wind doesn’t always blow and the sun doesn’t always shine when power is needed.

With lower battery costs, companies can now afford to invest in battery storage alongside their solar or wind farms. Energy is generated, stored in a battery system, then fed into the grid based on power prices. For example, last summer, generator Vistra Energy (parent company of TXU Energy) announced plans for a 42 MWh storage facility connected to a solar farm in Texas, which would be the state’s largest battery.

Batteries will also play a role in grid reliability with “Behind the Meter” or BTM applications. Batteries installed in businesses, industrial sites and even in the home can store power during off-peak times or from on-site solar installations. They use the power for their own consumption or feed it back to the grid at a profit.

Community solar (or shared solar) will also continue to grow, especially in the northeast. In community solar, developers sell solar shares to members of the community, to offset a portion of their electricity usage. Participants receive a credit on their electricity bill, based on the portion of the solar generation asset they “own.” Both Massachusetts and New York have implemented clean energy incentives to encourage investment in community solar.

Delivery Rates will Continue to Rise

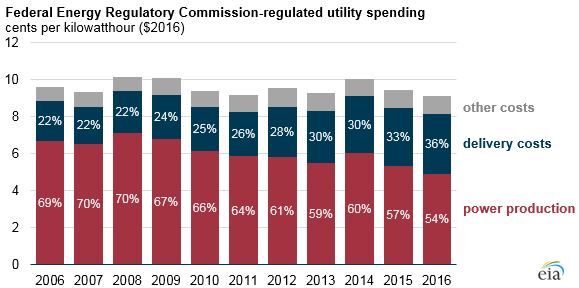

Utility companies across the country will continue to invest in their distribution and transmission networks. Since 2011, these infrastructure investments have risen dramatically. Utility companies need to replace and upgrade aging transmission systems. Reliability and cyber-security standards add cost. And new renewable and natural gas generation facilities must be tied into the grid.

For many consumers, the cost of delivery from the local utility is now more than one third of the bill. In some markets, utility delivery fees make up more than half of the bill! That’s confirmed by the numbers. According to the EIA, the portion of total electricity cost related to power production has gone from 69% in 2006 to 54% in 2016. Delivery costs have gone from 22% of the total cost of electricity in 2006 to 36% in 2016.

Consumers are rate payers to the local utility, with delivery rates approved by the local Public Utility Commission. Delivery rates are out of your control. However, if you are in a deregulated energy market such as Texas, Ohio or Connecticut, you can control what you pay for the supply portion of your electricity bill. Shopping for a new supplier lets you select a plan that meets your needs — whether that’s a fixed rate plan, a free time electricity plan, prepaid electricity or green energy.

Home Automation Will Go Mainstream

Who would have guessed 5 years ago that the phrase “Alexa, adjust my thermostat” would be part of our vocabulary? Yet today, voice enabled technologies are everywhere. Nearly a quarter of US homes have a voice-activated digital assistant. Most consumers still use their device for music or to search for weather information. But we predict that voice activated devices tied to smart thermostats, smart LEDs and smart switches will become more common in 2019.

Read More: Smart Home Technology Saves You Money >>

Some innovative electricity providers are working to integrate home batteries, home automation and smart thermostats to manage electricity consumption on your behalf. Typically, these offerings include real-time pricing exposure to the markets. Your provider will charge up your home battery during off-peak hours, make adjustments to your heating and cooling to conserve energy, and sell stored power into the energy markets using Peer to Peer (P2P) blockchain transactions. Sound a little unreal? It will take another 5-8 years for this to go mainstream, but it’s a trend to watch.

The Bottom Line For Electricity Rates in 2019

The net effect of these market factors will likely lead to a rise in 2019 residential and commercial electricity rates in the US. How much? It will depend on your region, your electricity supplier, and your specific utility. Unfortunately, it could be anywhere between 2-10% for new contracts, depending on when you last shopped.

For tips to find a better electricity plan, see The Basics: How to Shop for an Electricity Plan.

Want to see our projections from 2018? Here’s our Energy Trends to Watch in 2018 article.