Texas electricity rate trends for 2025 show prices similar to 2024. Our Texas electricity rates trend forecast includes key factors driving electricity prices and what types of electricity plans will be popular this year.

Whether you live in Houston, Dallas or another area, the question is always, “Will electricity prices in Texas go down anytime soon?” Don’t bet on it.

Key Takeaways

For 2025, here are 4 key takeaways on Texas electricity rate trends.

- Texas electricity prices for 2025 will continue at levels seen in 2024. Residential electricity rates will average 15-18¢ per kWh including delivery costs.

- Longer term contract terms (24 to 36 months) will be the cheapest electricity options.

- Pricing continues to show seasonality, with the best time to shop for electricity in the spring and fall.

- Texas commercial electricity rates for 2025 will be in the 7-9¢ per kWh range, plus delivery costs.

Texas Electricity Rates in 2025 – Average Price

- Average electricity rate in AEP Texas Central: 16.17¢ per kWh

- Average electricity rate in AEP Texas North: 17.72¢ per kWh

- Average electricity rate in CenterPoint Energy: 15.66¢ per kWh

- Average electricity rate in Lubbock Power & Light: 17.42¢ per kWh

- Average electricity rate in Oncor: 16.18¢ per kWh

- Average electricity rate in TNMP: 18.06¢ per kWh

Shop Texas Residential Electricity Rates by Zip Code

Find the cheapest electricity plans in Texas.

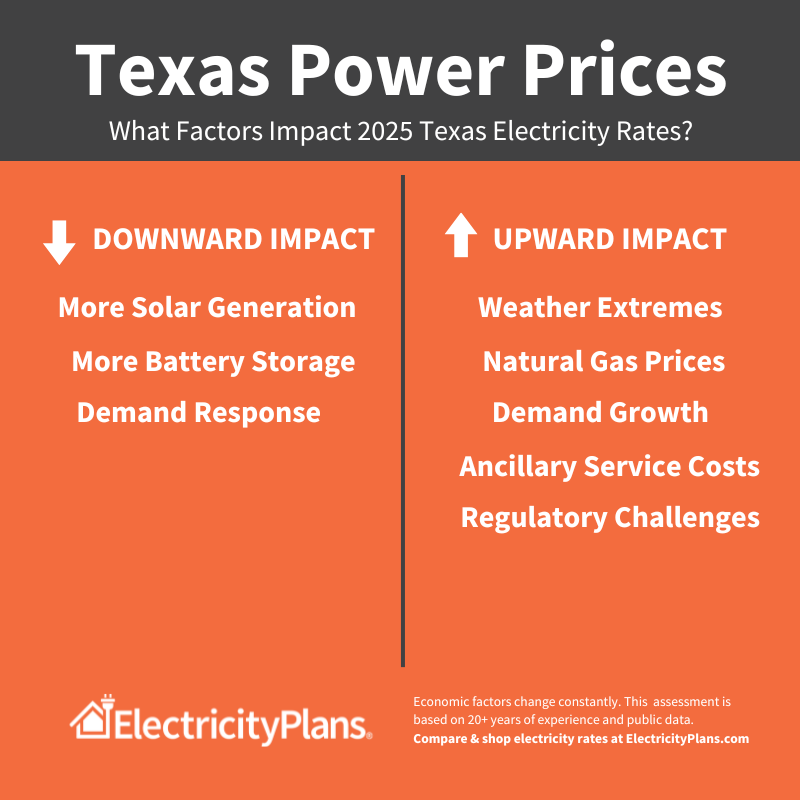

Factors That Drive Texas Electricity Rates

There are a number of key factors that drive Texas electricity prices. Our assessment is based on 20+ years of experience in the electricity market plus input from industry professionals.

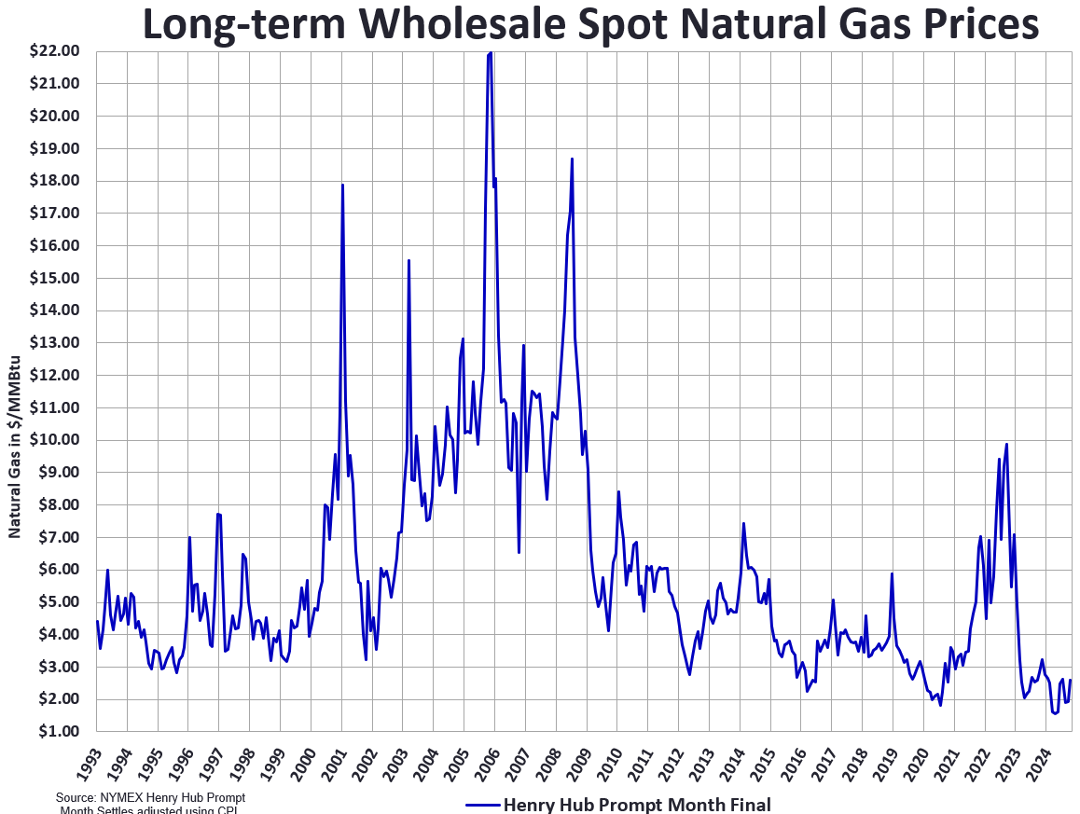

- Natural Gas Prices. Natural gas prices used to be the biggest drive of power prices in Texas. After all, natural gas accounts for 45% of electricity production in Texas. And these more expensive dispatchable generation resources usually set the marginal cost of power. Gas prices have hit record lows since 2022 (see graph below) but we haven’t seen any relief in power prices. Instead, electricity prices in Texas haven’t remained elevated due to other factors.

- Regulatory Changes. ERCOT implemented market structure changes after 2021’s Winter Storm Uri to increase grid stability. New ancillary services fees increase wholesale costs and your price.

- Supply & Demand. Texas’ demand for electricity has increased almost 20% in the last 5 years. Texas electricity demand growth is being being driven by three factors: (a) artificial intelligence and data centers, (b) cryptocurrency mining and (c) hydrogen electrolysis, an energy intensive industrial process. Most new generation in 2024 will come from solar and battery storage.

- Weather Patterns. 2024 was the new hottest year on record across Texas. But we also have a pattern of extreme cold for brief periods each winter. This weather drives higher trading prices for electricity in the summer and in January, driving up the overall cost of your contract.

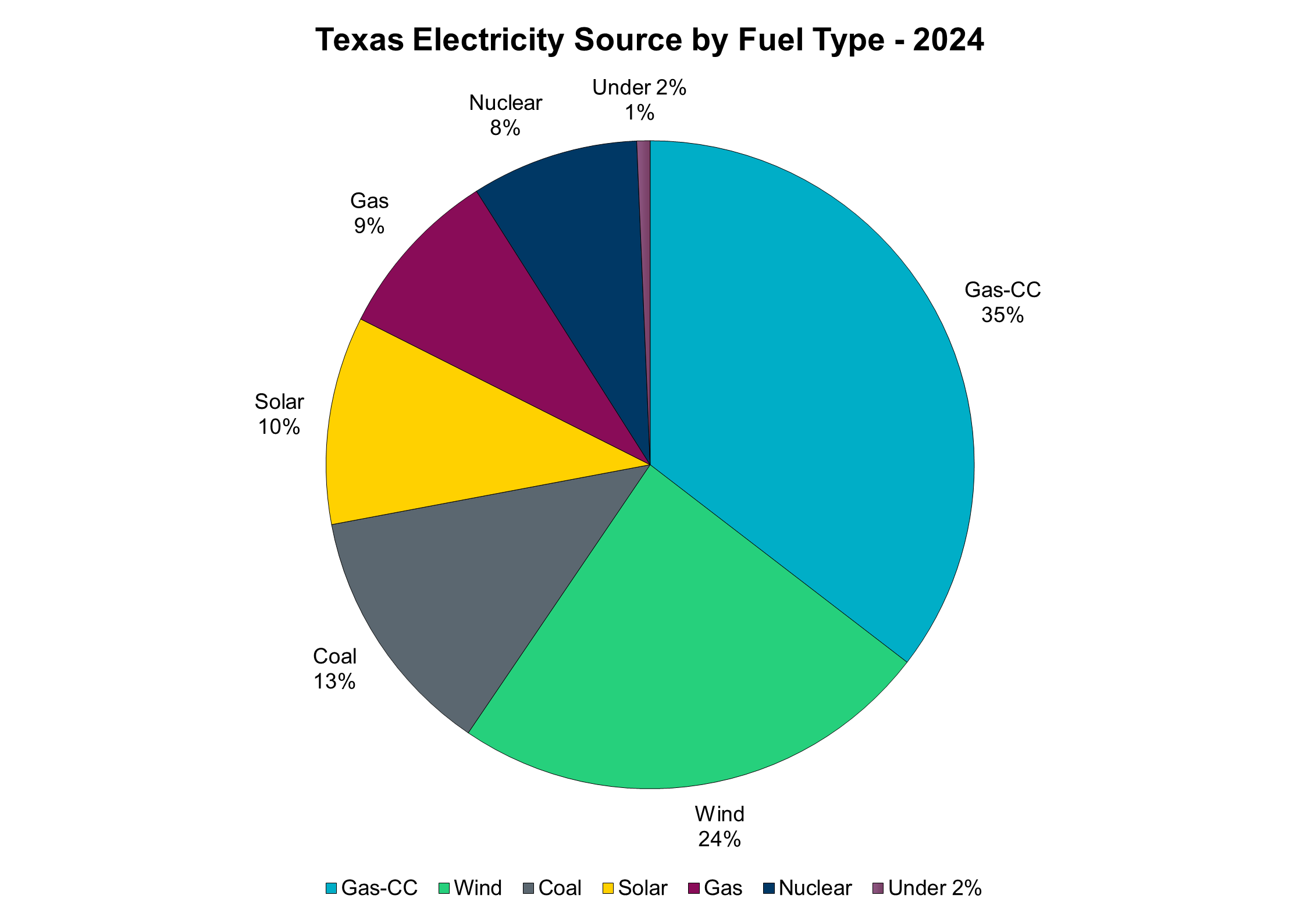

- Changing Generation Mix. Wind and solar now provide nearly 1/3 of our power. This lower cost electricity generation pushes wholesale prices down, but transmission costs to get the power to population centers could increase delivery fees.

Texas Electricity Plan Trends for 2025

In 2024, most residential Texas consumers selected a 12-month fixed rate contract term for their electricity plan. You can see historical energy trends in our 2024 wrap-up of Texas electricity stats.

For 2025, we expect that:

- Fixed rate electricity plans will continue to be the most popular type of electricity plans in Texas. That’s because no nonsense, no gimmicks basic electricity plans with fixed rates offer the best value for most consumers.

- Retail electricity providers will continue to offer bill credit and tiered rate plans that show a low rate at a specific usage level. While we do show these plans on our site, we encourage consumers to use our electricity plan calculator and Compare Plans tools to see what they will actually pay.

- Time of use plans will emerge to match new ERCOT supply curves. More solar and wind on the grid means lower priced daytime electricity, higher priced evening power and cheap nighttime electricity. Rhythm Energy’s PowerShift is one such time of use plan.

Short Term vs. Long Term Power Contacts in 2025

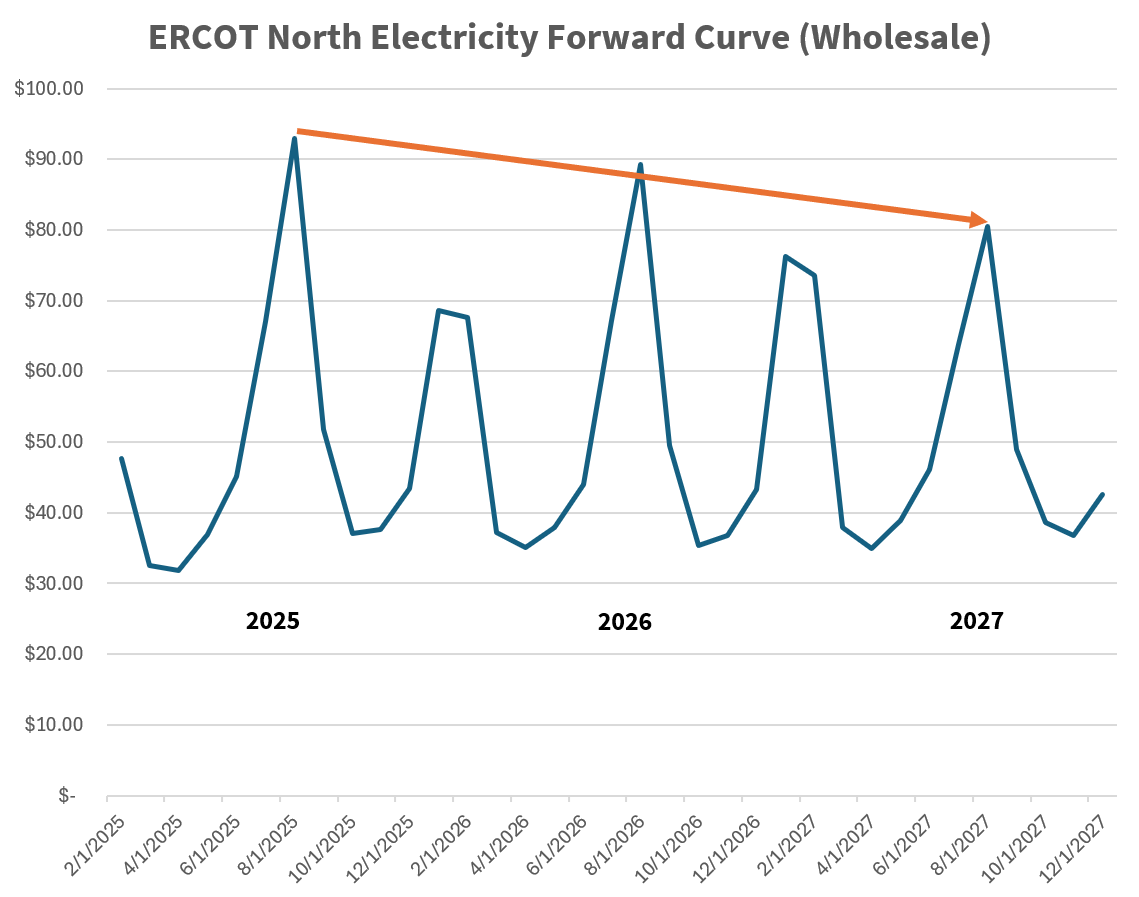

Following trends that we’ve seen for the past 2 years, long term contracts will provide the best value in Texas electricity rates in 2025.

That’s not to say there won’t be opportunities where short term contracts offer a great rate. In fact, if you see an odd-term contract (like 8, 11, 14 months etc.), take a good look. Odd-term contracts are created to take advantage of market prices.

But right now, wholesale electricity prices for 2025 electricity are trading at a premium. Wholesale contracts for 2026 and 2027 power are less expensive. That means you’ll likely get a better rate with a 24 or 36 month plan vs. a 12 month plan.

Beyond that, the economics of supply and demand point to higher prices in the future.

- ERCOT forecasts a 50% increase in electricity demand by 2029, with demand growth driven by AI data centers, cryptocurrency and industrial processes.

- Most new power will come from solar farms and battery storage, but new transmission lines are needed. New gas power plants will lag because gas turbines are supply-constrained through 2030.

- Ancillary services, designed to ensure that power is always available to the grid, increase costs and risks which affect your rates.

- Market uncertainties also drive prices. Power traders are eyeing tariffs on steel and solar panels; lower natural gas storage paired with increasing gas exports; and Texas legislative debates on the power market structure.

> Learn More: What’s Driving Electricity Demand in Texas?

If you’re concerned about committing to a longer term contract? Consider selecting a from this list of electricity companies with a satisfaction guarantee. Try your new company for 30, 60 or even 90 days, and switch away or switch to a new plan if you aren’t satisfied.

Shop Texas Electricity Rates by Zip Code

Politics & Power – Will Electricity Prices Go Down Under the Trump Administration?

Consumer prices were a big discussion item during the 2024 election cycle. With slogans like “drill baby drill”, President-Elect Trump promised that consumers would see their energy bills cut in half. The reality is not that simple.

In the short term, a change in administration at the national level is unlikely to impact your electricity bill in Texas. In the long term, here are some factors that may come into play:

- Removal of a ban of new permits for LNG (liquified natural gas) facilities will serve to grow the market for US natural gas abroad. This will likely drive natural gas prices higher over the long term.

- Reduction in emissions requirements may extend the life of older natural gas and coal power plants which could drive prices down.

- Reduced incentives for renewable energy projects could increase the cost of renewable electricity, which would drive prices up.

- Tariffs on steel and solar panels will increase the cost to build new power generation assets.

Private companies that develop generation assets are driven by market prices and their return on investment. Time will tell what changes will emerge in the long run.

Texas Electricity Predictions and Price Forecast for 2025

The trends we observed in 2024 will likely continue into 2025. On a broader scale:

- Texas has to brace for population changes and the energy usage accompanying such shifts. Texas 2036, a non-profit public policy research group, created a Energy Dashboard to monitor these changes, especially as the state’s electricity demand is predicted to double between now and 2050. Behind this trend, four million more workers may arrive between 2025 and 2050.

- Greater energy demand and renewables might lower long-term wholesale prices. Texas 2036 observes that prices could decline from $35-40/MWh range in 2025 to under $30/MWh by 2050 and potentially stunt investment in energy expansion projects. On the other hand, greater use of renewables may also decrease demand for traditional sources and lower the overall price.

- In the more immediate future, this dichotomy could cancel the gains renewables have made in Texas’s market. According to a report from S&P Global, pushing out solar and other green projects coupled with the growing load from business investments means that Texas’ electricity reserves may be challenged.

- Solar power continues to grow, especially in Texas. According to an EIA report, Texas is at the helm of solar power expansion, with adoption to increase by 54% in 2025. At the same time, EIA predicts 5% less coal-powered generation in Texas this year.

- AI and data centers: We keep hearing about the benefits of artificial intelligence. And while these tools streamline communication and business operations, they come with a cost. Data centers require power to sift through all the information out there and produce results. As adoption and integration surge, the EIA predicts a 60% higher demand in power for these facilities — or about 10% of ERCOT’s grid.

Texas Electricity Trends FAQs

Texas electricity prices for 2025 will continue at levels seen in 2024. Residential electricity rates will average 14-18¢ per kWh in 2025, including delivery costs.

The Texas long-term electricity price forecast for 2026 looks positive based on ERCOT reserve margins and forward market contracts. However, that can change based on regulatory concerns, market jitters and weather. Residential customers can protect their electricity rate for 2026 by securing a 2 or 3 year electricity contract now.

Electricity prices in Texas have increased 20% over the last 5 years, according to data from the EIA. Higher prices are driven by increasing demand, regulatory changes, weather conditions and aging infrastructure. You can see how Texas electricity rates rank vs. other states in this chart of electricity rates by state, updated monthly.

The best time to shop for electricity rates in Texas is spring and fall. Rates are historically at their lowest in April, May and October. And rates are typically highest in July, August, January and February.

ERCOT forecasts a 2025 peak demand of 90,336 MW (Source: May 2024 ERCOT CDR Report). As a comparison, ERCOT hit a record peak demand of 85,931 MW on August 31, 2024. Peak demand is the highest amount of electricity used in a given time period. ERCOT (Electric Reliability Council of Texas) is the non-profit organization that manages the state’s electrical grid.

Texas electricity increasingly comes from renewable energy. In 2024, 34% of Texas electricity came from wind and solar. By comparison, just 10 years prior, in 2014, 11% of Texas electricity came from wind and solar. Consumers can choose traditional energy, which is a mix of power sources, or green energy from renewable sources.

Overall, Texas continues to rely on natural gas for the majority of its power generation. In 2024, 44% of power was generated by natural gas. Wind was the next largest source of power, accounting for 24% of power generation. Coal generated 13%, Solar 10%, Nuclear 8% and Other (including hydroelectric and biofuels) generating under 2%. (Source: ERCOT)